Key Developments

- Interest Rate Steady: The Bank of Canada decided to keep its policy interest rate unchanged at 5% on April 10th. Their next upcoming meeting is on June 5th, 2024.

- Inflation Watch: Inflation increased to 2.9% in March from 2.8% in February. This kept inflation inside the Bank of Canada’s target range (1-3%) for the 2nd consecutive month. April’s inflation report will be released on May 21st

- Mortgage Rates Check: For those in the house-hunting phase or considering a refinance, the best 5-year fixed mortgage rate from the Big 6 Banks is currently sitting at 4.84% (source: ratehub.ca) which is the first time I’ve seen one below 5% in over a year. This continues the downward trend on fixed rates. If you’re in need of a mortgage professional, get in touch and I’m happy to recommend someone I know, like, and trust.

Slight change to the format this month. Before my April market update, I want to quickly cover some items of interest in this year’s federal budget as it pertains to housing and real estate.

The Federal Governments goal is to build 4,000,000 new homes by 2031 since supply is the biggest factor when it comes to affordability right now. They plan to do this through various means, including:

- converting government-owned properties into residential housing

- removing red tape for builders (details are sparse here)

- providing low-cost loans to builders

- Building more essential infrastructure like power lines, transit, water, wastewater, etc in areas where these homes will be built

How realistic their goal is remains to be seen. Right now we build about 200,000 new homes a year. At that pace, we would be at about 1,200,000 homes by 2031. That means they would need to build about 233% more homes a year (a total of 670,000). Seems like a pretty big stretch.

This also doesn’t help with short-term affordability, so what changes have they proposed that help buyers today?

Federal Budget Announcements Related to Housing

RRSP Withdrawal Limit Increase

This is actually a big one considering how pricey down payments are getting in the GTA. The plan is to increase the RRSP Withdrawal Limit from $35,000 to $60,000. They are also extending the grace period for when this needs to be paid back.

Typically this money needs to be put back into your RRSP over a 15-year period, the first repayment due the second year after the withdrawal was made. Under the planned budget, this grace period would increase to 5 years before the first repayment needs to be made.

This means a couple could use up to $120,000 from their RRSPs, and if they have been contributing the maximum $8,000 a year to their FHSA could access an additional $32,000 of tax-free money to their downpayment.

30-year mortgages for first-time homebuyers purchasing new builds

The Federal Goverment is planning to bring back 30-year amortizations as of August 21st, 2024. This is to help with monthly mortgage payment affordability, but only under specific conditions:

- Must be a first-time homebuyer

- Must be purchasing a new build or pre-construction property

- Must be an insured mortgage (less than 20% down payment)

This mortgage amortization relief may also be available to existing homeowners who meet specific eligibility criteria (though I wasn’t able to find what those criteria are). This could help existing homeowners lower monthly mortgage payments by extending their mortgages until we are in a more favorable interest rate environment.

Increase on capital gains tax inclusion rates

The capital gains tax inclusion rate will increase from 50% to 66.6% on any capital gains above $250,000 for individuals, corporations and trusts. This would come into effect June 25th, 2024 if approved.

I’d like to note, this does not change the capital gains exemption on primary residences.

In terms of real estate implications, this will have the biggest impact on people who own a secondary residence like a cottage or an income property that has had significant appreciation since purchasing. We may see some of these individuals try to offload secondary properties before the higher tax comes in.

For example, if you had $500,000 of capital gains on the sale of a secondary property. $125,000 (50%) of the first $250,000 would be eligible to taxation and $166,500 (66.6%) on the second $250,000 would be eligible to taxation.

That works out to $250,000 being eligible for taxation before June 25th, and $291,500 after. This would be taxed at your marginal tax rate.

If you have concerns about these changes, I would be happy to discuss them and I will get any answers I can about these changes from my tax expert!

Restrictions on Corporations buying single-family homes

There is a big problem in the United States with Hedge Funds, and Real Estate Investment Trusts (REITs) buying up single-family homes as speculative assets.

The Federal Government is getting ahead of that trend in Canada proposing restrictions to these types of buyers so that you’re not competing against multi-billion dollar corporations on offer nights!

Overall these are positive short-term changes, but it’s likely to be years before we see any of these plans help with housing affordability, since supply is the problem and it takes time to build them!

April Market Update

As you know, I love to watch offer nights when I’m not participating in them to get an idea of buyer sentiment and where the market is headed.

Over the last 2-3 weeks of April I have started to feel a shift in the market that I did not anticipate based on the TRREB numbers that came out in March. March is typically one of the slower months in the spring market because of Easter Weekend and March Break.

This past March was REALLY slow historically speaking. The 2nd lowest sales ever in the month of March (next to 2009), and the 4th lowest New Listings (March 2023 was the lowest, and 2002, 2003 were the 2nd and 3rd). The lack of inventory is the reason the market is so sluggish right now.

With March being so slow, I was anticipating a spike in activity in April, especially because there are no school or public holidays. Instead, I am seeing fewer and fewer offers come in on offer nights I am watching.

10/10 houses are still getting all the love and doing really well. So much so that one of my clients snagged a beautiful home in multiples earlier this month, and shortly after, we were approached by the 2nd place buyer offering them an extra $50,000 to assign them the sale. That’s how scarce quality inventory is!

Alternatively, B-tier homes that were fetching a high number of offers and performing well in early 2024 are experiencing failed offer nights and being re-listed over the last 2-3 weeks.

It’s honestly a bit confusing out there right now. I don’t know if we can expect this slow-down to last, but there does seem to be some preliminary indication of softer conditions for buyers out there right now while we wait to hear what the Bank of Canada will do in June.

The BoC will have another inflation report, and more employment data to work with by their next meeting, and Tiff Macklem has stated recently that a rate cut in June is in the realm of possibilities.

If a rate cut does happen, buyers who didn’t take advantage of the soft conditions right now might be kicking themselves in a few months.

As always if you have more specific questions, need advice, or want to talk about what I’m seeing out there, get in touch. I’m always happy to talk shop!

March 2024 TRREB Stats

Average Sale Price

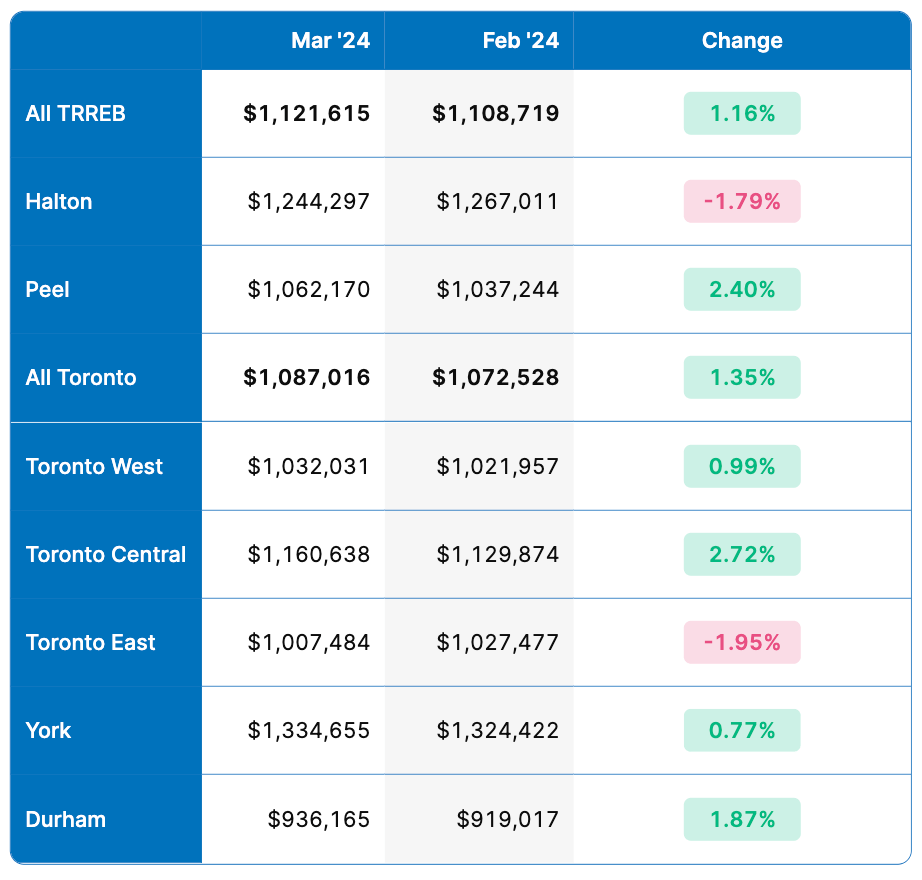

As I mentioned, March is typically one of the slower months in the spring market because of Easter and March Break. That being said, we did see an increase in Average Sale Price of +1.16% across all TRREB and +1.35% in Toronto.

Average Sale Prices Month-over-month (All Property Types, March 2024 vs February 2024)

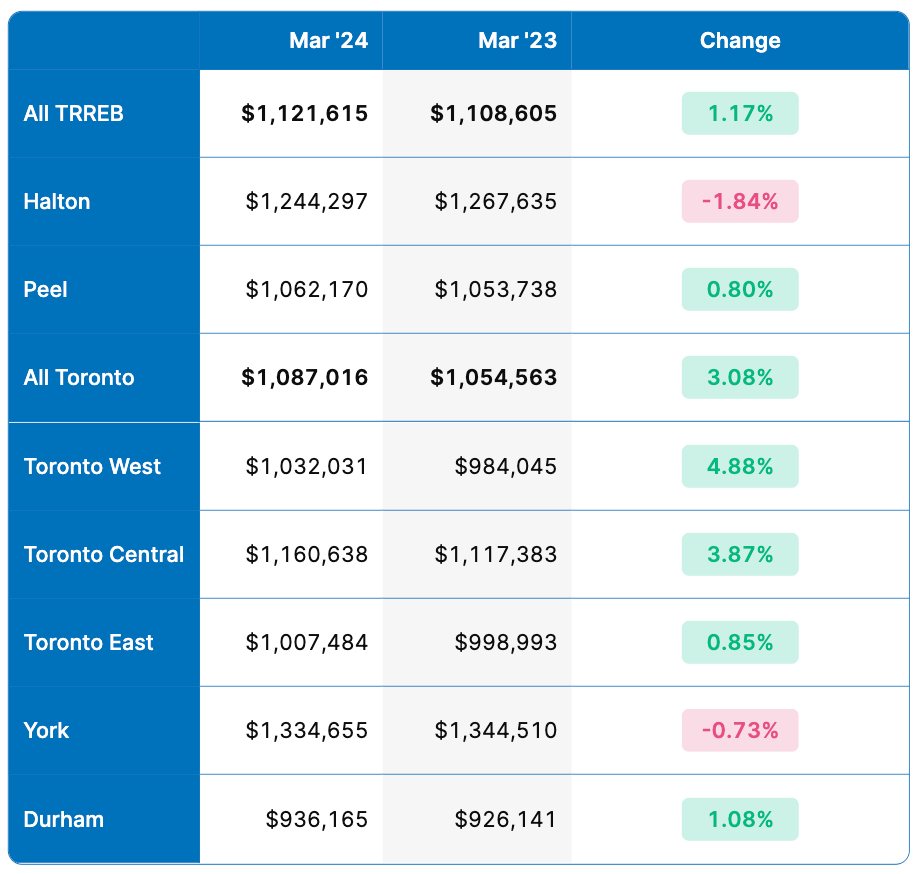

Comparing to March 2023 sales prices stayed fairly flat across TRREB with a year-over-year increase of 1.17%. Toronto faired better with a 3.08% increase (see table below).

Average Sale Prices Year-over-year (All Property Types, March 2024 vs 2023)

New Listings

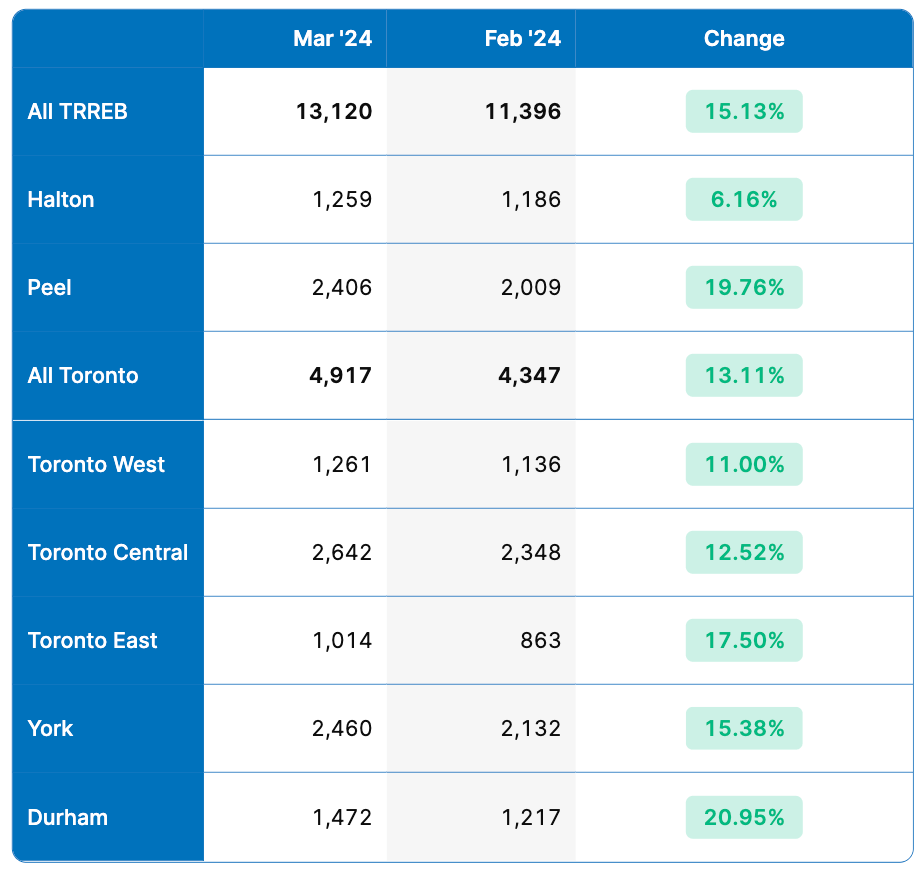

New listings continued to remain low, but did see a month-over-month increase of 15.13% from February across all TRREB and 13.11% in Toronto.

New Listings Month-over-month (All Property Types, March 2024 vs February 2024)

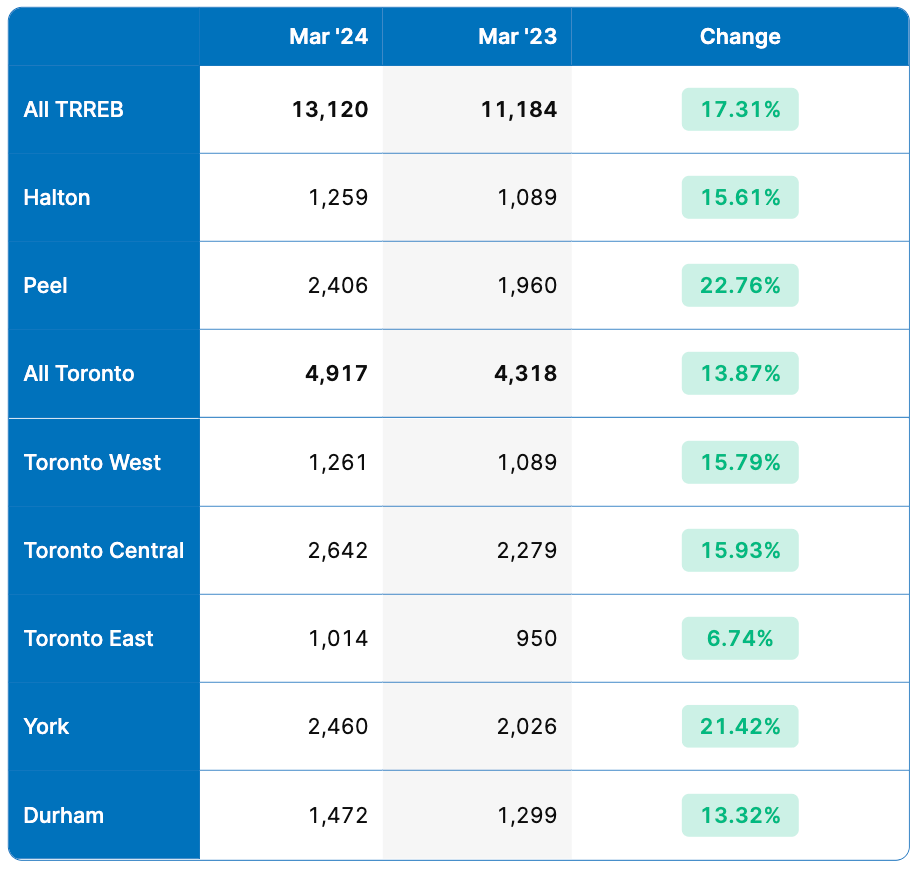

We also saw a year-over-year increase of 17.31% across all of TRREB and 13.87% in Toronto (see table below).

New Listings Year-over-year (All Property Types, March 2024 vs 2023)

While these percentages might seem big, historically speaking the number of new listings is very low.

Sales

Month-over-month sales increased 17% across TRREB 17.1% in Toronto vs February (see table below). Take this with a grain of salt, because sales were also historically low in February so 17% isn’t a huge increase. For context we saw a 42% increase from February 2021 to March 2021 at the peak of the market, which is more typical historically speaking.

Sales Month-over-month (All Property Types, March 2024 vs February 2024)

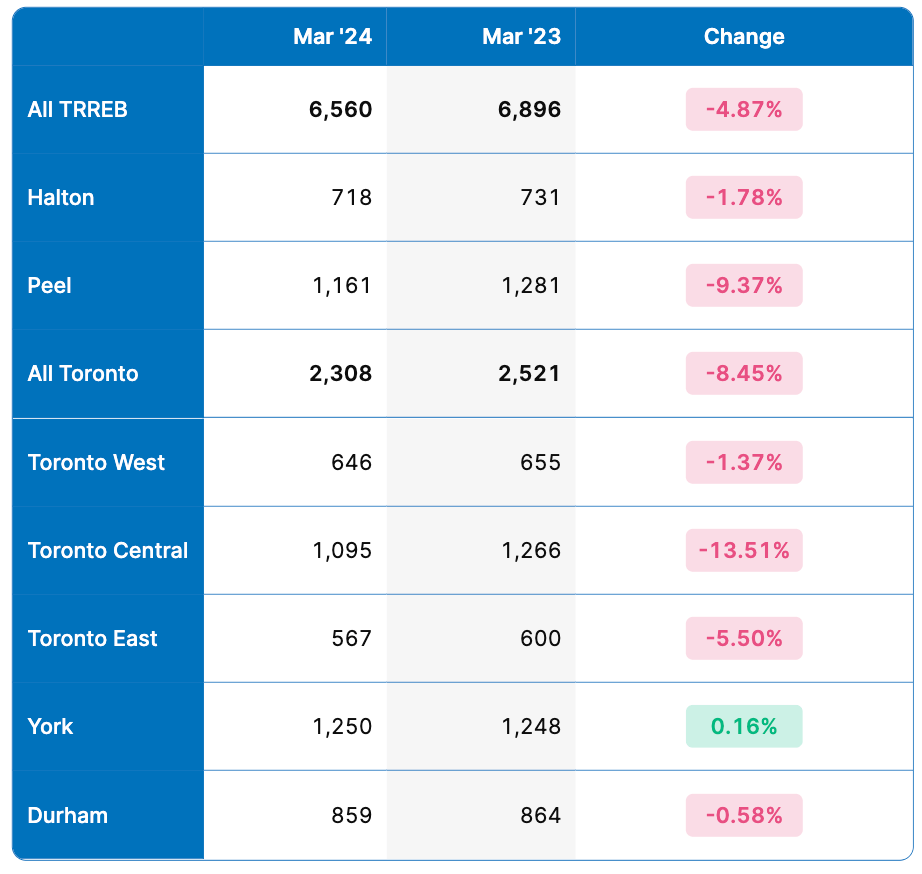

Year-over-year sales decreased 4.87% across TRREB and 8.45% in Toronto from March 2023 (see table below).

Sales Year-over-year (All Property Types, March 2024 vs 2023)

As always if you have more specific questions, need advice, or want to talk about what I’m seeing out there, get in touch. I’m always happy to talk shop!