Key Developments

- Interest Rate Reduction: The Bank of Canada cut the policy interest rate by 25 basis points to 4.75% on June 5th, 2024. This is the first rate cut since March 2020, and is a significant moment for the housing market since this aggressive rate-hike cycle started in early 2022. Their next upcoming meeting is on July 24th, 2024.

- Inflation Watch: Inflation decreased to 2.7% in April from 2.9% in March. This kept inflation inside the Bank of Canada’s target range (1-3%) for the 3rd consecutive month. May’s inflation report will be released on June 25th

- Mortgage Rates Check: For those in the house-hunting phase or considering a refinance, the best 5-year fixed mortgage rate from the Big 6 Banks is currently sitting at 4.84% which has been stagnant for the last two months (source: ratehub.ca). With many homeowners refinancing this year, we could see buyer’s start pivoting to variable rate mortgages if they believe rates will continue to be cut. If you’re in need of a mortgage professional, get in touch and I’m happy to recommend someone I know, like, and trust.

The news has been bombarded with articles about the Bank of Canada’s recent interest rate cut which has been hotly anticipated throughout the spring market. While I won’t go into too much detail on this market update, I wrote some of my thoughts on what it means for the market in this blog post.

I’d recommend taking a look if you’re thinking about, or in the process of buying or selling as I go over past rate-cutting cycles and what has happened historically.

May TRREB Stats

Right now I want to talk about the current state of the market as we potentially venture into a rate-cutting cycle. The May TRREB stats were released on the same day as the interest rate announcement, and they don’t look great on the surface for a month that is generally strong in the spring market.

I’ve felt some softening in competition among buyers over the last two months. Inventory is up and sales are down, but despite that prices are holding up well considering supply is outweighing demand.

Average Sale Price

The year-over-year average sale price across TRREB is down 2.54% from May 2023, and about flat in Toronto (see table below)

Average Sale Price Year-over-year (All Property Types, May 2024 vs May 2023)

I think there is some significance that year-over-year prices have remained flat in Toronto considering that in May 2023 the interest rate was at 4.5%, 50 basis points lower than in May 2024 (5%), with no sign back then that the Bank of Canada was finished hiking rates.

We do have to factor in year-over-year inflation when analyzing annual statistics. In this context, the Toronto market hasn’t kept pace with annual inflation, indicating that the market is effectively down compared to last May.

If we break down the proportion of sales of different property types in May 2024 vs May 2023, lower Condo sales and a higher proportion of Freehold sales (detached, semi-detached) are likely playing a role (see table below).

Proportion of Sales by Property Type Year-over-year (Toronto, May 2024 vs May 2023)

In May 2024, Freehold sales made up 41.65% and Condo sales made up 48.02% of sales whereas in 2023 Freeholds made up 38.24% and Condo sales made up 51.57%.

Higher Freehold sales in May 2024 will skew the average sale price higher, so considering these two factors, I think real appreciation/depreciation is probably lower than what the data shows.

Month-over-month prices have stayed fairly flat across TRREB, but Toronto has seen some better appreciation with a 3.5% increase in Toronto. (see table below)

Average Sale Price Month-over-month (All Property Types, May 2024 vs April 2024)

But again, the proportion of property types sold is probably playing some role here. The proportion of Freeholds to Condos was higher in May 2024 than in April 2024 (see table below).

Proportion of Sales by Property Type Month-over-month (Toronto, May 2024 vs April 2024)

All this being said, I would actually expect prices to have come in softer based on the Sales and New Listings data.

Supply & Demand (Sales to New Listings)

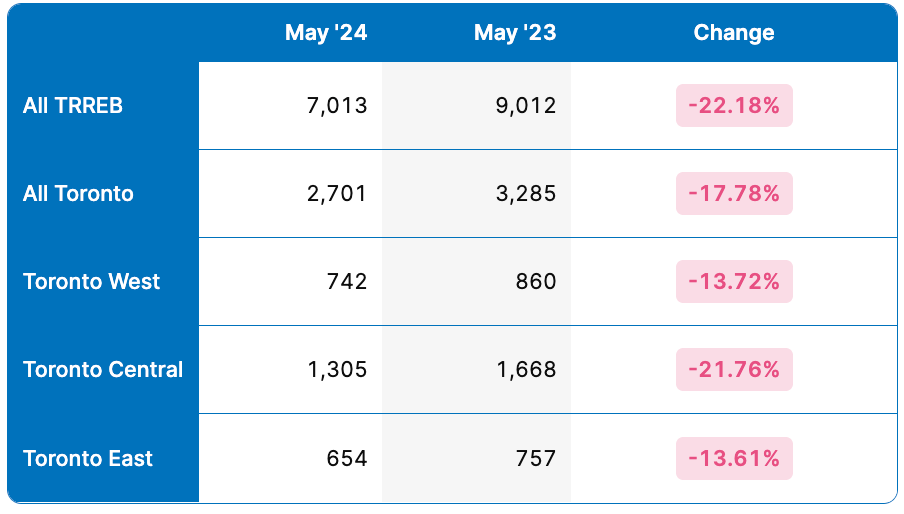

If we look at the table below, you can see that we had 22% fewer sales across TRREB, and 18% fewer sales in Toronto this May compared to May 2023.

Sales Year-over-year (All Property Types, May 2024 vs May 2023)

But we had 22.5% more listings across TRREB, and 28% in Toronto (see table below).

New Listings Year-over-year (All Property Types, May 2024 vs May 2023)

Supply is seriously outweighing demand right now based on this data. If we view this as a Sales-to-New-Listing Ratio (SNLR), we’re at 37.7% across TRREB and 36.7% in Toronto, compared to May 2023 where the SNLR was 59.3% across TRREB and 57.3% in Toronto (see table below).

Sales to New Listings Ratio Year-over-year (All Property Types, May 2024 vs May 2023)

That’s the lowest SNLR in the month of May in the last 20 years and firmly indicates a Buyers market. Despite that, prices have held up well overall, and actually increased month-over-month in Toronto as I said earlier.

So what’s happening here? The New Listings stat is partially misleading.

A common practice among realtors is to refresh their listings by canceling and re-listing them on MLS. Instead of making a price change, re-listing categorizes the listing as a New Listing, pushing it to the top of MLS search results and resetting the Days on Market to zero. This makes the listing appear fresh in buyers’ MLS feeds.

While this strategy effectively attracts fresh eyes to a listing, it has a downside: TRREB double-counts the listing. For example, if a house was listed in April, didn’t sell, was canceled, and re-listed in May, it would count as a New Listing in both April and May.

You can see in the table below this was indeed the case in May 2024. The share of new listings that were re-lists was right around 24%, compared to 11% in May 2023 where most of the New Listings were actually “new”.

Adjusted Sales to New Listings Ratio Year-over-year (All Property Types, May 2024 vs May 2023)

As a result, the Sales-to-New-Listing Ratio is closer to 50% in reality which shows a more balanced market – the imbalance of supply and demand is not as severe as it seems.

Final Thoughts

Quality properties in desirable areas are still receiving multiple competitive offers when priced correctly. Some buyers have been anticipating rate cuts throughout the spring market, creating competition for these properties as they try to purchase before rates potentially decrease and competition intensifies.

Even though there is more supply right now than a year ago, rates were on the way up last year, whereas the forecast in spring 2024 has been for rate cuts. I think this is why prices have held up well overall despite supply and demand stats that would suggest otherwise.

With economists predicting another 50 basis points of cuts by the end of 2024, what will this mean for the market moving into summer, fall, and next spring?

To understand what may happen in the future, we have to look at past rate-cutting cycles and how they impacted the real estate market. For more on that topic, read this blog post.

As always if you have more specific questions, need advice, or want to talk about what I’m seeing out there, get in touch. I’m always happy to talk shop!