Key Developments

- Interest Rate Steady: The Bank of Canada decided to keep its policy interest rate unchanged at 5% in October. We’ll see what they decide next at their upcoming meeting on December 6th.

- Inflation Watch: October’s inflation numbers are due on November 21st. September saw CPI Inflation decrease to 3.8% from 4.0% in August. It’s an essential metric, as it can influence future decisions on interest rates.

- Mortgage Rates Check: For those in the house-hunting phase or considering a refinance, the average 5-year fixed mortgage rate from the Big 6 Banks is currently sitting at 5.84% (source: ratehub.ca) which is a slight increase from last month. If you’re in need of a mortgage professional, get in touch and I’m happy to recommend someone I know, like, and trust.

The October TRREB numbers came out last week, and the absorption rate was historically low again. As a recap, the absorption rate is the ratio of sales to new listings in a given month. This October it was about 32.3% (4,646 sales to 14,397 new listings) up 3.7 basis points from 28.6% in September.

Last month I mentioned that September had the lowest absorption rate of any September in the last 20 years, and while it did increase slighlty in October, it is still the lowest absorption rate in October in the last 20 years.

Anything below 50% would be considered a buyer’s market, so 32.3% definitely puts us in that category. Such an imbalance between supply and demand would make you think that the average sale price would have gone down in October. I was surprised to find out that prices increased slightly by 0.6% month-over-month and 3.35% year-over-year.

It’s perplexing that the average sale price increased because the market conditions that I’m experiencing and tracking are not showing signs that buyers are willing to pay more for properties today than they were in August or September. So I’m taking that stat with a grain of salt.

Whats Been Happening on Offer Nights

I tracked 491 Offer nights in October, and I’ve tracked 928 since the start of the fall market (Novembers are not included here as it’s a small sample size at this point)

| October | September | |

|---|---|---|

| All Property Types | ||

| –Offer Nights Tracked | 491 | 400 |

| –Did Not Sell | 74% (361) | 65% (258) |

| –Zero Offers | 60% (293) | 50% (199) |

| Condo | ||

| –Offer Nights Tracked | 209 | 120 |

| –Did Not Sell | 88% (183) | 78% (93) |

| –Zero Offers | 73% (152) | 66% (72) |

| Detached | ||

| –Offer Nights Tracked | 129 | 138 |

| –Did Not Sell | 66% (85) | 66% (91) |

| –Zero Offers | 53% (68) | 50% (69) |

| Semi/Townhouse | ||

| –Offer Nights Tracked | 153 | 142 |

| –Did Not Sell | 61% (93) | 52%(74) |

| –Zero Offers | 48% (73) | 41% (58) |

74% of properties not selling on offer night is a pretty telling number in terms of buyer demand (based on Toronto’s recent history around bidding wars). 3 out of 4 properties are getting no offers. This is one of the reasons I was taken aback by the average sale price increase.

I’m still surprised how many sellers and their agents are opting to have offer nights. Especially on the Condo side where nearly 90% did not sell. From what I’ve been watching, unless you have a very special property, you’re better off letting buyers make offers at their convenience.

If you want to discuss my findings in more detail feel free to reach out! Now let’s dive into the October TRREB Stats.

October TRREB Stats

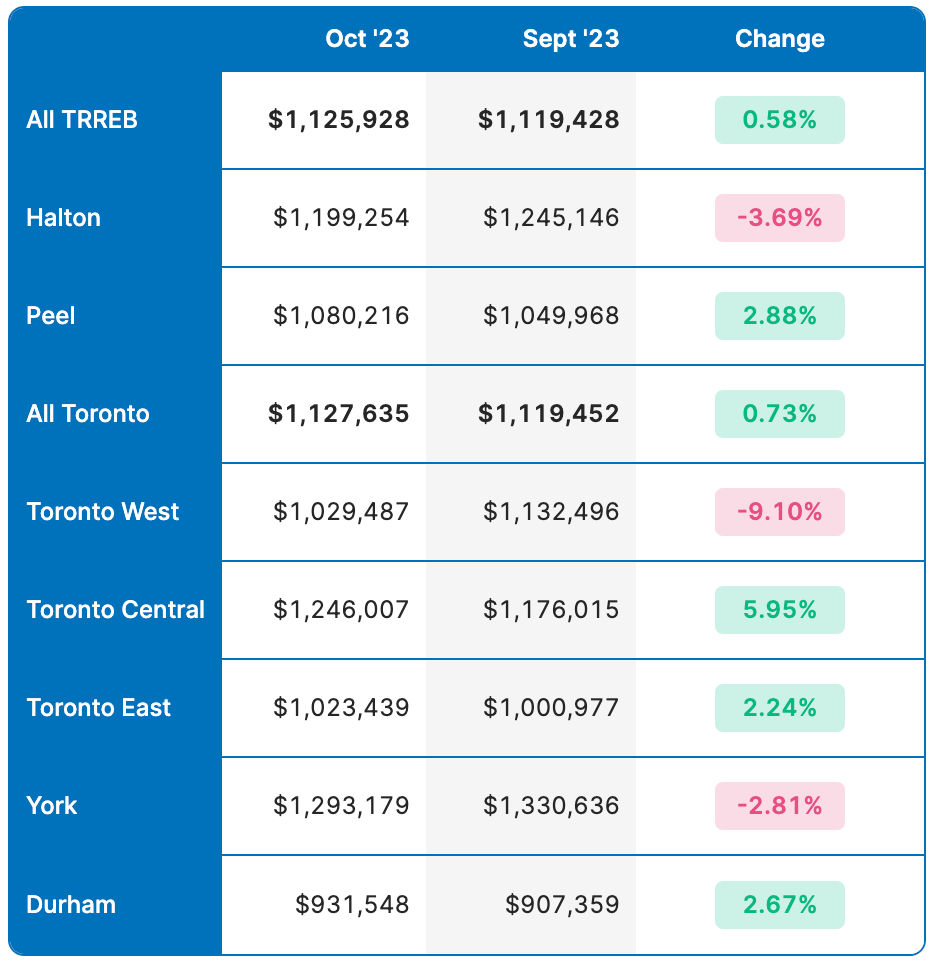

Average Sale Price (Month-over-month)

As mentioned above, the average sale price rose 0.6% month-over-month across all TRREB regions, and 0.76% in Toronto.

Average Sale Prices Month-over-month (All Property Types, October 2023 vs September 2023)

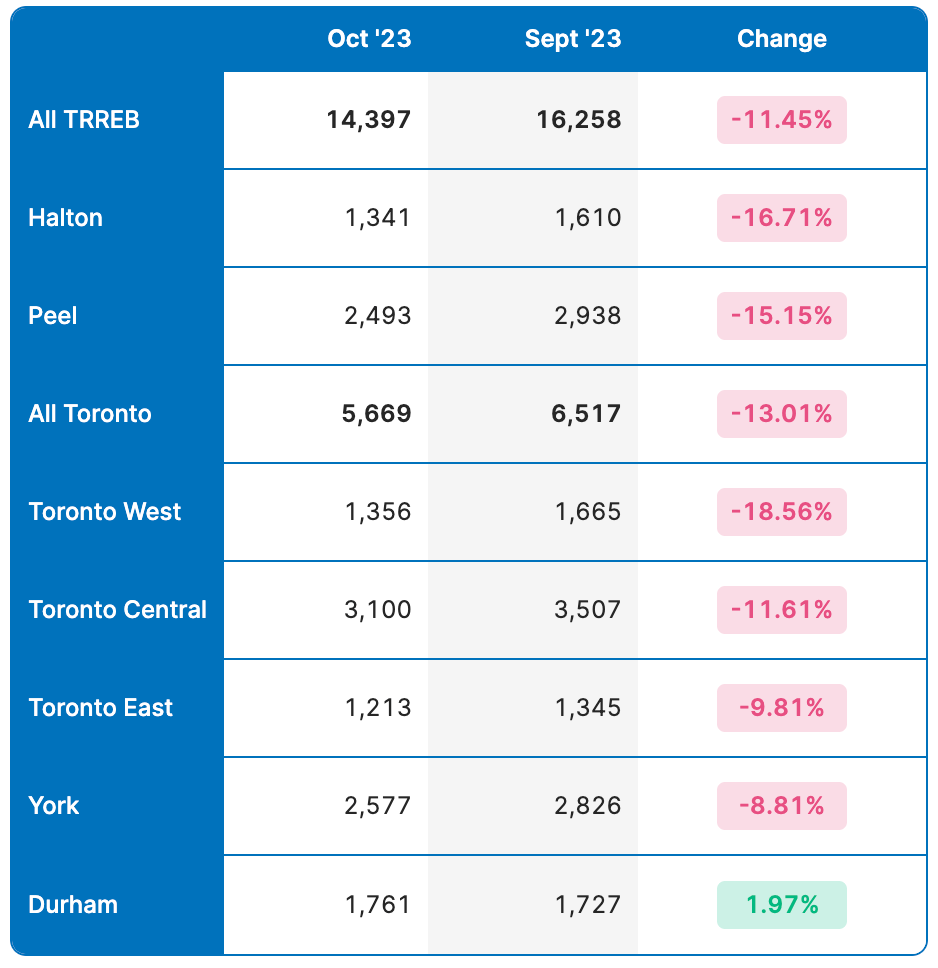

New Listings (Month-over-month)

New listings fell 11.35% across all TRREB regions, and 13% in Toronto. I don’t think this is a big enough decrease in supply to explain how the average sale price stayed consistent over last month since the absorption rate was still so low.

New Listings Month-over-month (All Property Types, October 2023 vs September 2023)

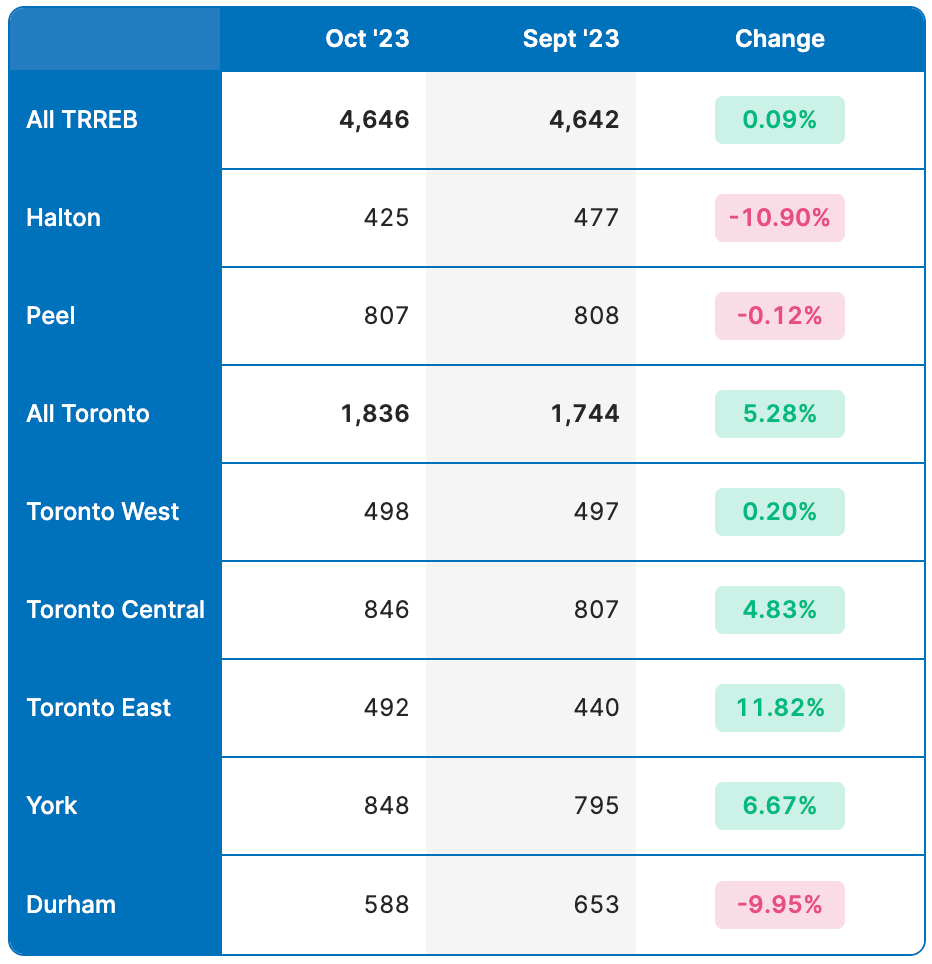

Sales (Month-over-month)

Month-over-month sales across all TRREB regions were almost identical with only 4 more sales in October than we had in September. There was also a 5.28% increase in sales in Toronto, which was mainly concentrated in the detached and semi-detached markets.

Sales Month-over-month (All Property Types, October 2023 vs September 2023)

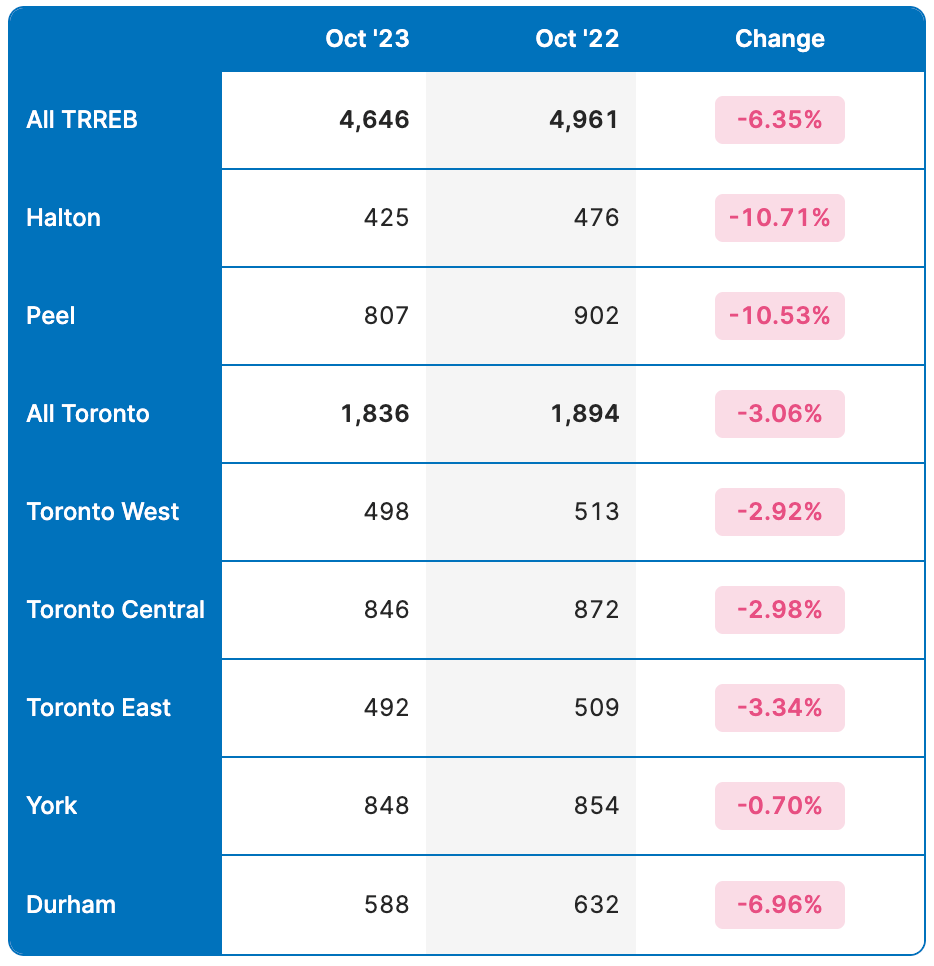

4,646 sales is the lowest in the month of October dating back to 2002 and the second straight month below 5,000 sales. It’s the only 2nd October in the last 20 years where sales have fallen below 5,000 for the month, the first time being last year in October 2022.

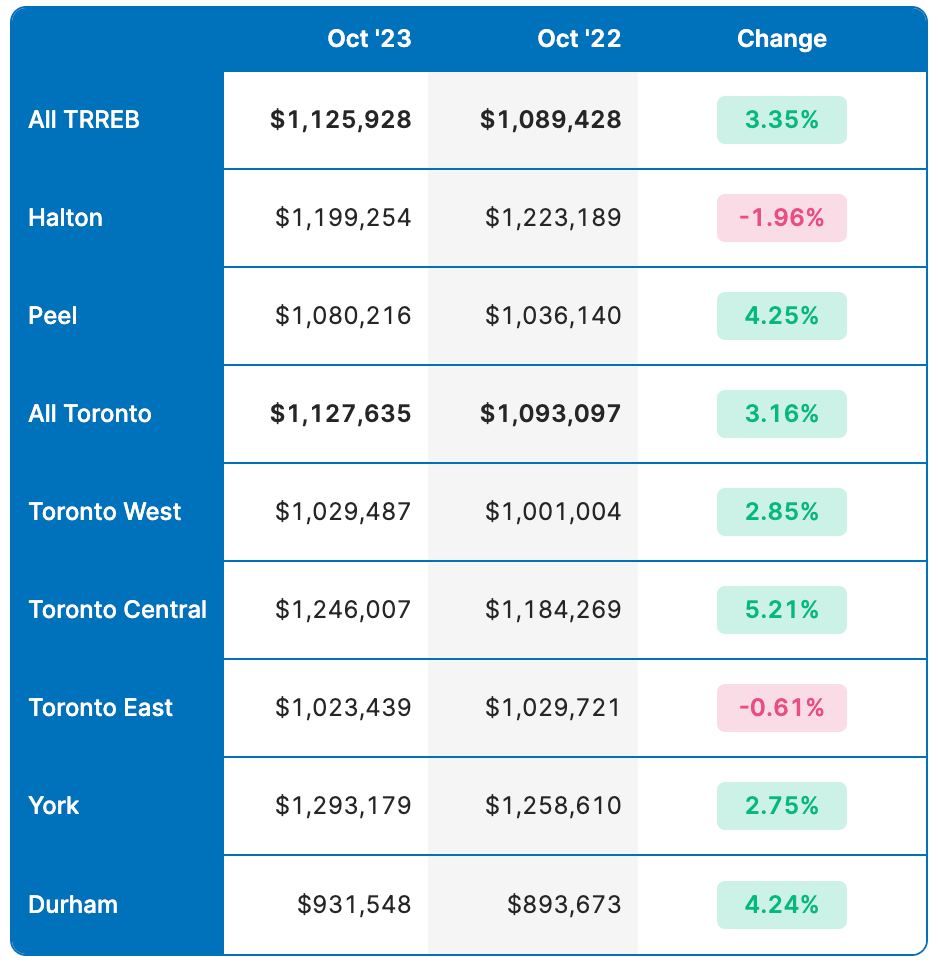

Average Sale Price (year-over-year)

Average sale prices rose ~3.4% across all TRREB regions from and ~3.2% in Toronto since October 2022. Most of this appreciation was in the detached and semi-detached market. The average sale price in the Condo market declined 1.1% across all TRREB regions and 1.51% in Toronto.

Average Sale Price Year-over-year (All Property Types, October 2023 vs 2022)

Sales (year-over-year)

Looking at sales we can see that there was a decline of almost 6.35% across all TRREB regions and 3.06% in Toronto.

Sales Year-over-year (All Property Types, October 2023 vs 2022)

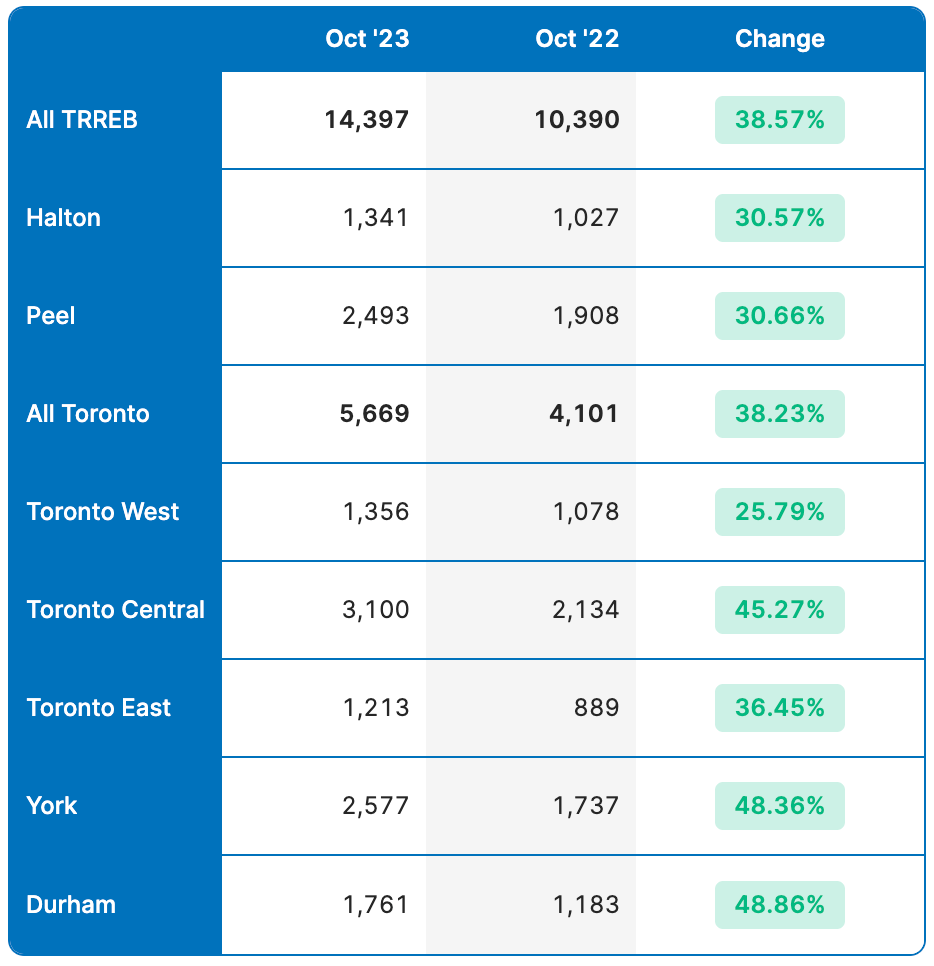

The decrease in sales is made more significant when we see the supply increase year-over-year.

New Listings (year-over-year)

New Listings are up 38.6% across all TRREB regions, and 38.2% in Toronto. That’s over 4,000 more listings on the market this October compared to last.

New Listings Year-over-year (All Property Types, October 2023 vs 2022)

Final Thoughts

In last months report I said if I were a betting woman, I’d put my money on home prices flatlining or declining the rest of the fall market. While a 0.6% increase could be considered flatlining, I technically would’ve lost that bet 🙂

That being said, supply is heavily outweighing demand right now, illustrated in both the absorption rate, and what I’ve tracked on offer nights. Coupled with the fact that prices cyclically drop in November, I’d double down on last months bet.

Since the Bank of Canada doesn’t have another rate decision until December 6th, I don’t really see many reasons November will be any different than what we’ve seen thus far in the fall market, and would also expect to see December be much quieter than previous years. Expect more of the same to wrap up 2023.

As always if you have more specific questions, need advice, or want to talk about what I’m seeing out there, get in touch. I’m always happy to talk shop!