Key Developments

- Interest Rate Steady: The Bank of Canada decided to keep its policy interest rate unchanged at 5% in September. We’ll see what they decide next at their upcoming meeting on October 25th.

- Inflation Watch: I’ve got my eye on the inflation data. September’s CPI report is due on October 17th. August saw CPI Inflation go up to 4.0% from 3.3% in July. It’s an essential metric, as it can influence future decisions on interest rates.

- Mortgage Rates Check: For those in the house-hunting phase or considering a refinance, the average 5-year fixed mortgage rate from the Big 6 Banks is currently sitting at 5.69% (source: ratehub.ca) which is unchanged from last month. If you’re in need of a mortgage professional, get in touch and I’m happy to recommend someone I know, like, and trust.

The September TRREB numbers came out last week, and wow is the absorption rate low. What is the absorption rate? It’s the ratio of sales to new listings in a given month. This September it was about 29% (4,642 sales to 16,258 new listings). Written in plain English, that would be about 1 sale for every 3 homes listed in September.

It’s the lowest I’ve seen in years and the lowest in 20 years. In fact, it has never been below 38% in September since TRREB started to track this data in 2002.

Most institutions will tell you 40-60% would be considered a balanced market, but I would say as you approach 60%, you’re moving into more of a seller’s market, and we’ve been above 60% fairly consistently for the last number of years (upwards of 80% at the peak of the market in 2021). At 29% we are almost certainly in the midst of a Buyer’s Market.

Aimee’s Experience

Funny enough, I already knew we were going to see an absorption rate in the 20-30% range because I am a psychic… 😉

Jokes aside, if you’ve worked with me during the past few years, or read any of my market updates, you probably already know I obsessively track offer nights. I do it because I can’t rely on month-old TRREB data to guide my clients on what’s going on in the current market. I want to see up-to-the-minute data to combine with my experiences in the trenches.

Since the start of the summer I could tell September 2023 was going to be a pivotal month for the direction of the market, so I tracked every offer night I could. 556 to be exact!

How I do it is my little secret, but believe me, it’s a lot of manual work! Here are some key insights I found:

September (400 Offer Nights)

- 64.5% (258) did not sell on offer night

- Of the 258, only 14% (36) eventually sold with a different pricing/offer strategy

- 50% (199) of the offer nights received 0 offers

- Condos

- 120 offer nights tracked

- 77.5% (93) did not sell

- 66% (72) received 0 offers

- Detached

- 138 offer nights tracked

- 66% (91) did not sell

- 50% (69) received 0 offers

- Semi-Detached/Townhouses

- 142 offer nights tracked

- 52% (74) did not sell

- 41% (58) received 0 offers

October (156 Offer Nights…so far)

This is a smaller sample size, so some of these numbers may change by the end of the month. That being said, Detached and Semi-detached percentages thus far are very close to September, while Condo demand seems to be softer than in September based on the offer nights I I’ve tracked so far in October.

- 69% (108) did not sell on offer night

- 61% (95) of the offer nights received 0 offers

- Condos

- 59 offer nights tracked

- 85% (50) did not sell

- 75% (44) received 0 offers

- Detached

- 47 offer nights tracked

- 66% (31) did not sell

- 60% (28) received 0 offers

- Semi-Detached/Townhouses

- 50 offer nights tracked

- 54% (27) did not sell

- 46% (23) received 0 offers

Having this information before anyone else has been a secret weapon in negotiations for my clients (both buyers and sellers) so far this fall. A lot of listing agents I’ve worked with recently were acting under the assumption that this fall market was/would be similar to the hot spring market, (some even referencing sales from the height of the market in February 2022!) and were adopting pricing/offer strategies accordingly.

The absorption rate reported by TRREB only confirmed what I’ve been telling my clients and these other agents for weeks. Buyer demand has dropped significantly. Buyers are still active, however, they have both more choice and in many situations more time to make a decision.

The most recent TRREB data will be an eye-opener for many. I would expect to see a shift in listing strategies away from offer nights for the remainder of the year (unless it’s an exceptional 10/10 property). There are naturally some properties that are still fairing very well on their offer nights, but it’s very critical to be mindful of what the best listing strategy is for each individual property.

If you want to discuss my findings in more detail feel free to reach out! Now let’s dive into the September TRREB Stats, to see how things have played out so far this fall.

September TRREB Stats

Average Sale Price (Month-over-month)

The average sale price rose 3.4% month-over-month. I wasn’t expecting as large an increase based on everything I just discussed. I believe that the types of properties being sold was the largest contributor to this increase. Condos made up a larger portion of sales in August than in September, meaning other more expensive property types like Detached and Semi-detached made up a smaller portion of sales in August.

In August, Detached, Semi-detached, and Townhouse properties made up 60.56% of sales, whereas that number increased to 63.96% in September. A difference of…

…wait for it… 3.4%.

I would argue that prices were actually flatter than these numbers suggest.

Average Sale Prices Month-over-month (All Property Types, September 2023 vs August 2023)

I had similar findings in Toronto. Average sale price increased 11.3% from August. Detached, Semi-detached, and Townhouse properties made up 34.06% of sales in August, whereas September those property types made up 44.55%. That’s a 10.5% difference which is very close to the average price increase of 11.3%.

New Listings (Month-over-month)

Supply is way up, with new listings up 32% across TRREB and up 50% in Toronto. We haven’t seen this many listings hit the market in September since before the pandemic (2017, 2018 ,2019)

New Listings Month-over-month (All Property Types, September 2023 vs August 2023)

Sales (Month-over-month)

Sales were down about 12% across TRREB, which I initially thought was very abnormal from August to September, but I was wrong. 9 out of the last 21 years sales have decreased from August to September.

Sales Month-over-month (All Property Types, September 2023 vs August 2023)

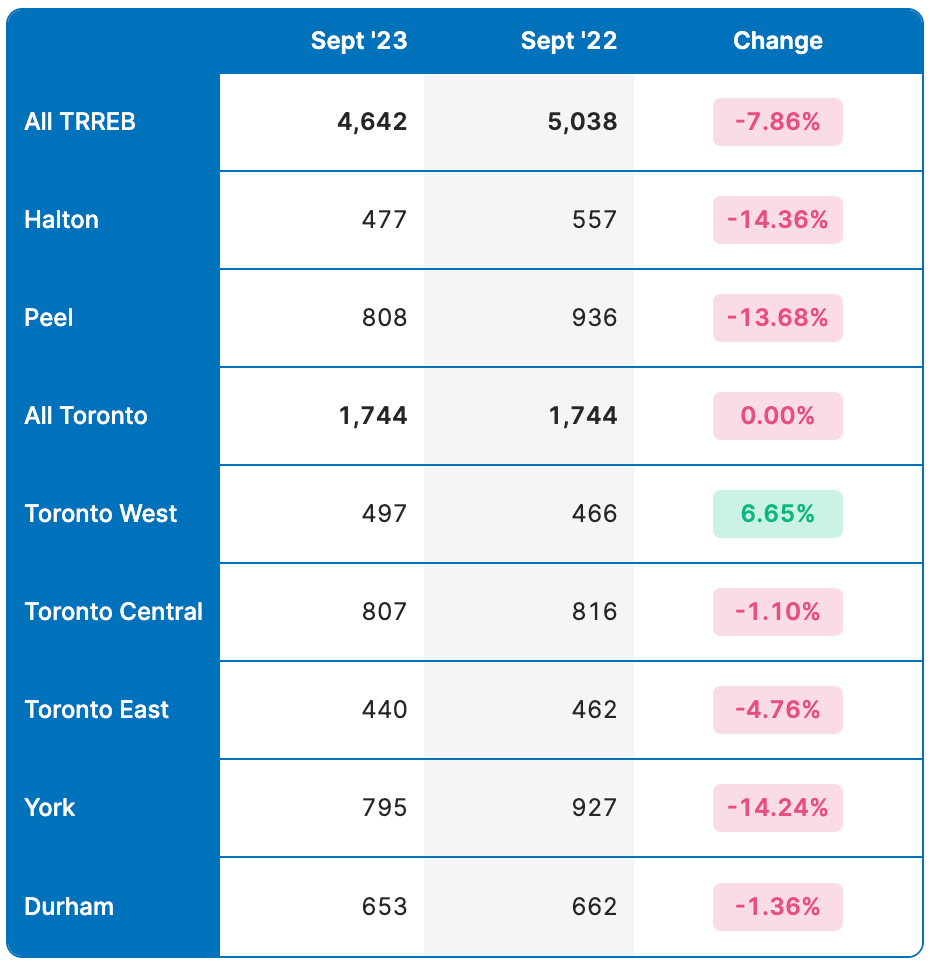

4,642 sales is the lowest in the month of September dating back to 2002. In fact, it’s the only September in the last 21 years to have less than 5,000 sales (the previous low was 5,038 in September 2022).

Suffice it to say, that buyer demand was very subdued in September 2023 which seems to be continuing in October based on what I’m seeing on the ground.

Average Sale Price (year-over-year)

Average sale prices rose 3% from September 2022, and are sitting just below where they were in September 2021.

Average Sale Price Year-over-year (All Property Types, September 2023 vs 2022)

Sales (year-over-year)

Looking at sales we can see that there was a decline of almost 8% which again points to lower buyer demand.

Sales Year-over-year (All Property Types, September 2023 vs 2022)

The decrease in sales is made more significant when we see the supply increase year-over-year.

New Listings (year-over-year)

New Listings are up 44.7% and Active Listings (all listings currently on the market) were up 39.7% from last year. That’s over 5,000 more listings on the market this September compared to last.

New Listings Year-over-year (All Property Types, September 2023 vs 2022)

Absorption Rate (year-over-year)

Considering that there were over 5,000 more listings on the market in September 2023 from the previous year, it’s not surprising to see that the absorption rate fell 16 basis points.

A 44.8% absorption rate last September indicated a balanced market, a 28.6% rate this September almost certainly puts us in a Buyer’s Market.

Absorption Rate Year-over-year (All Property Types, September 2023 vs 2022)

Final Thoughts

Based on all of the above data, the offer nights I’ve tracked thus far in October, and my experiences on the ground to date, it’s clear that supply is well outweighing buyer demand right now. If I were a betting woman, I’d put my money on home prices flatlining or declining the rest of this fall market.

The only thing that would flip that narrative is if the Bank of Canada did a surprise rate cut at the end of the month, hinted at cuts early next year (both unlikely), or inventory completely drying up.

I think armed with this latest TRREB data, you will see buyers be a little more aggressive pushing back against sellers’ expectations. This is clearly not the best time to “offload” properties, but it is an advantageous time to purchase and or “move up”. There is more choice and more time to make decisions than we’ve had in a long time.

As always if you have more specific questions, need advice, or want to talk about what I’m seeing out there, get in touch. I’m always happy to talk shop!