We’re two months through the fall market, and it has been a slow one to say the least! September was historically slow in terms of number of sales, seeing the fewest in a September since 2002…(you can read more on that in last months report)

October didn’t fair much better in terms of number of sales/overall market activity. Quality inventory is still very low which is a trend continuing from September. For the most part, Seller’s with quality homes are holding off until the spring in hopes of a stronger sellers market.

In my opinion the lack of quality inventory, is one of the major drivers of this slow market.

However…

I have started to see some early signs of increased activity over the last week of October and first week of November. This isn’t reflected in TRREB’s latest data since it takes into account the entire month. So you’ll just have to take the word of a person who is very active, watches MLS like a hawk every day, keeps track of almost every offer night, and also speaks to a lot of agents and other industry professionals regularly (mortgage brokers, home inspectors, stagers, etc.).

In fact, this Fall market feels eerily similar to 2021…

Fall Market 2021 vs 2022

What happened in Fall 2021?

For brevity’s sake I am only going to look at central Toronto’s numbers for this comparison.

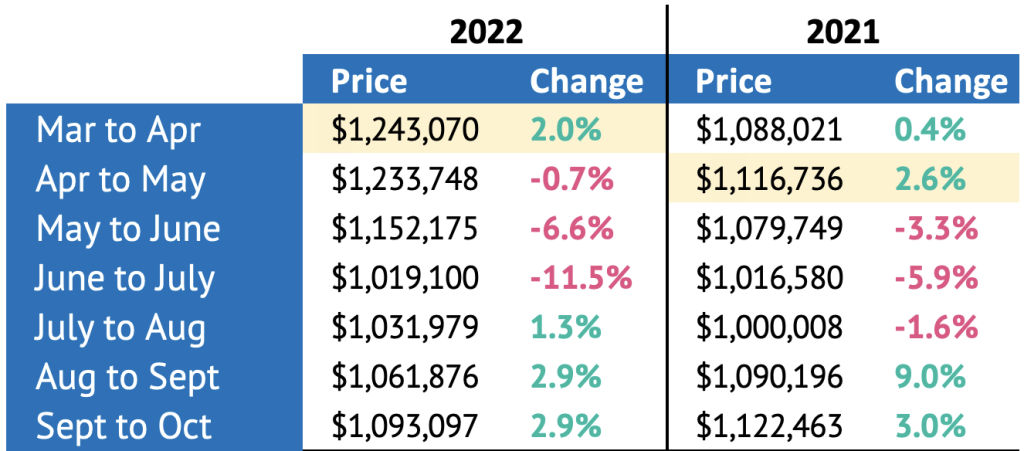

The table below shows month-over-month price appreciation from April to October for both 2021 & 2022.

2021

In 2021 the average sale price in Toronto peaked around May (highlighted in yellow) – though it felt like it peaked in April (to any active agent). A bunch of seller’s then decided this would be a good time to sell, that increased overall inventory and prices dropped over the late spring into the summer due to supply outweighing demand.

July and August are typically sluggish months, but I recall feeling that sellers jumped on the bandwagon too late in 2021 chasing the high benchmark prices. Remember, this was the lowest interest rates were in history, and the market still dropped 10% from peak to trough. Supply and demand is a very strong market factor (foreshadowing).

2022

In 2022 prices peaked around April (highlighted in yellow), though again, data aside, I feel they truly peaked in February, maybe March . Historical interest rate increases ensued, and prices dropped sharply for the next few months. Higher interest rates lowered demand, and supply started to build up in the market as seller’s were trying to cash in after the market peak had already passed (similar to 2021).

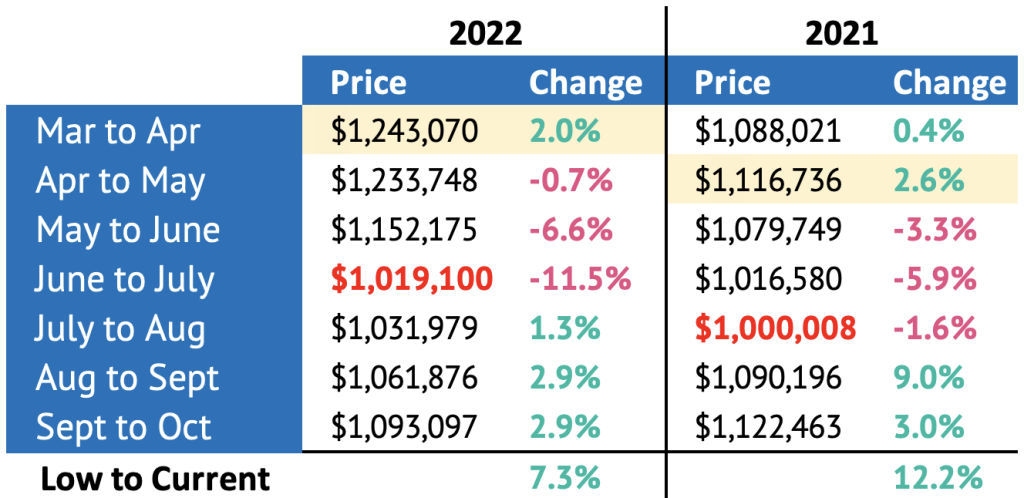

In both 2021 & 2022 it took three (3) months for the market to reach a low (see highlighted in red below). Obviously I can’t say we won’t find a new low in 2022 or 2023–for now July was it.

Market Bottoms

You can see in the table below, from 2021 low was in August (highlighted in red). The market proceded to completely recover, rising 12.2% in just 2 months. The reason? Market sentiment can shift quickly. Prices fell quickly in a short period, and Buyer’s started “buying the dip” in the fall. Demand started to outweigh supply, and prices sharply rose.

Again, data aside, the surge in buyer activity was felt in the third week of November 2021 and was very evident to me in December that prices (and buyer demand) were on the upswing. My gut told me January and February 2022 would be insane, and they were…until they reversed course with inflation and interest rate hike fears.

Looking to the 2022 lows (July) to the most recent TRREB data in October 2022, the Toronto market has recovered 7.3%. That is despite a 75 basis point interest rate hike in September. In fact, since that rate hike average sale prices have increased 3%.

We just had another 50 basis point hike last week, and as I mentioned earlier I am seeing signs of a small pickup in activity.

What’s strange at first glance is that there are about +20% more active listings on the market this year than there was last year.

You expect demand to be lower because of interest rates so we can reasonably assume supply is outweighing demand. But remember, quality inventory is low. So even though the data is telling us there is a good amount of inventory on the market, I can tell you from looking at every property that hits, real inventory is much lower in Toronto than it was last fall.

There’s still some demand in the marketplace despite interest rates, and as of right now it’s outweighing supply which I believe is the sole reason that prices have been on a gradual rise.

Where are we going from here?

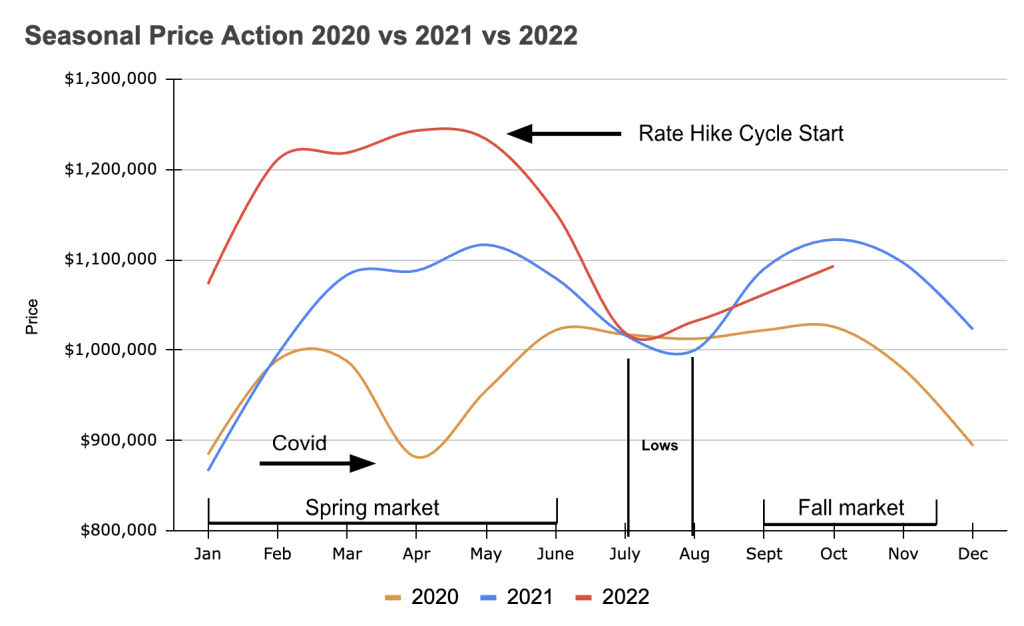

Let’s look at some trends over the last few spring and fall markets.

The spring market (Jan-June) has shown much higher growth than in the fall. Both the start of 2021 and 2022 had insane spring markets (we’re talking +20% gains in a matter of months). Had Covid not hit in 2020, I’d bet we would have seen the same.

In all 3 years there was a large price decline as we moved in to summer. What’s interesting to see is that in each of these instances, we seemed to find bottom around the $1 million average price mark that was the peak just before covid hit.

In both 2020 and 2021, the fall market ended with a sharp decline in average sale price of about -10% (see note below), before roaring back in the spring to hit new highs before eventually declining again in the summer.

Side Note

As activity drops towards the end of November into December for the holiday season, total number of overall sales almost halves. This can skew the average sale price lower if there are significantly less luxury home sales in that time period.

People aren’t actually buying homes for 10% less than the month before.

To date, 2022 has followed this same pattern, but we have one major difference as we head into the end of the fall market. Interest rates.

If interest rates were not a factor, I would be gearing up for a crazy spring market. But they are, and that makes things unpredictable.

That’s all I got for this month. I’ll share some quick TRREB stats below for those who are interested.

What I’ll Be Looking for in November

Another inflation report will come out this month that will have a big impact on what the Bank of Canada does at their next opportunity to raise interest rates on December 7th. The US released their inflation numbers today and they were much better than expected, so fingers crossed we get some good news as well.

The latest press release from the Bank of Canada suggests they are nearing the end of this rate hiking cycle, but I’ll believe it when I see it.

I’ll continue to do my thing and monitor market activity closely throughout the month, so if you’re looking for an update before my next one in early December don’t hesitate to reach out. I usually can spot things a month before they happen since I look at real time data.

That’s all I got for this month. I’ll share some quick TRREB stats below for those who are interested.

TRREB Stats

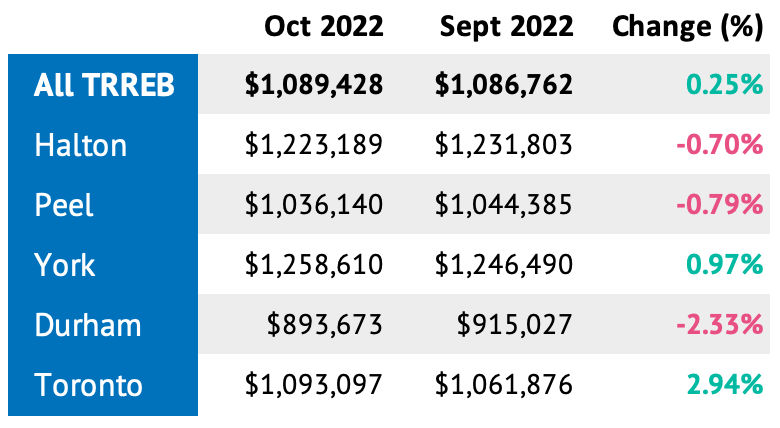

Average Sale Price Month-over-month

Since September 2022, there was prices stayed stable with a modest price gain of +0.25% across all of TRREB, with Toronto responsible for propping things rising +2.94%.

Last month I mentioned that we had started to see a bit of a price reversal in some areas (mainly Toronto):

- Toronto had see two consecutive months of price growth

- Durham had fallen slightly in September, but stayed above it’s July lows

- Halton had showed its first price gain since February of 2022 marking August as its most recent low

- York yet to find bottom

- Peel yet to find bottom

If we look at month-over-month price appreciation since the peak in February to October 2022, we can see which of these trends are continuing.

- Toronto posted it’s third straight month of price increases since hitting lows in July gaining almost +3% since September

- Durham has reversed course and posted a new low in October 2022 dropping -2.5%. Average sale price dropped below $900,000 for the first time since early 2021.

- Halton dropped slightly in October, but stayed above its August lows

- York posted a new low, dropping by just under -1%

- Peel posted its first gain since February 2022 marking September as it’s most recent low.

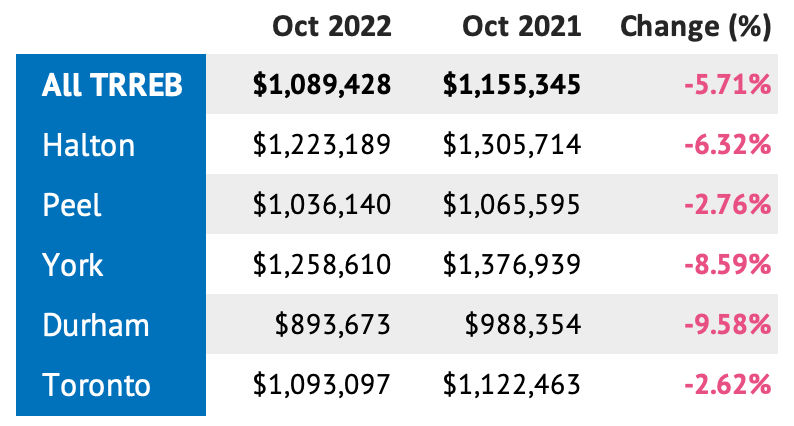

Average Sale Price Year-over-year

In last months report, I noted that September was the first month where we saw year-over-year average sale price being down across All TRREB regions. This continued in October, but again was not equal across all of TRREB.

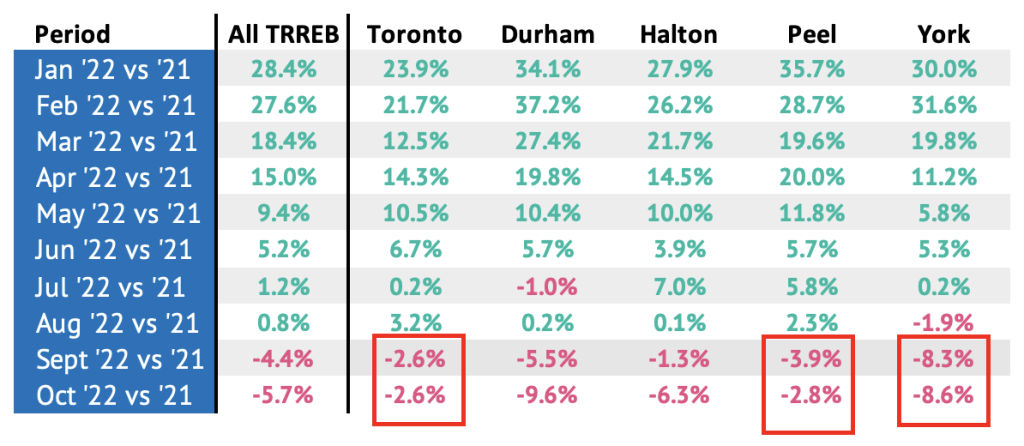

You can see in the table below that while Toronto, York and Peel regions (outlined in red) are down year-over-year in October, their year over year change stayed more or less stable after 9 months of steady decline. Durham and Halton have yet to show a sign of any bottom.

(If you have questions, need advice, or want to talk about what I’m seeing out there, get in touch).