The fall market is here! Last week, kids were just getting back to school, but the second week of September is where things usually start to pick up in terms of new listings and overall market activity .

I expect that to be the same this year.

What will be different than in years past? Well, looking back to my analysis of last month’s TRREB stats, I expect two things to continue:

- Number of sales will be lower than usual for this time of year

- New listings will be typical for this time of year, but supply will continue to outpace demand

Why? There has been little change in the macroeconomic conditions that have plagued us for the last 6 months.

If anything, the Bank of Canada’s 75 basis point increase to 3.25% is likely to exacerbate these trends by putting more pressure on renewing and variable rate mortgage holders, and making it harder for buyers to qualify.

With that being said, I want to discuss what happened in August, and see if any of these trends are showing signs of reversal.

August TRREB Stats

Number of Sales (August)

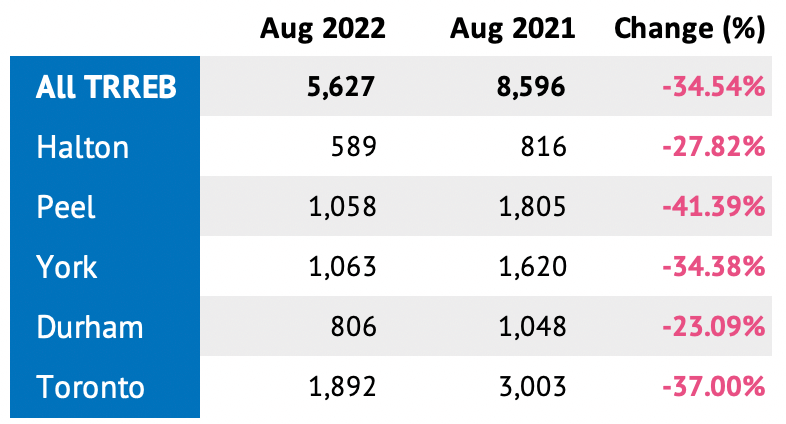

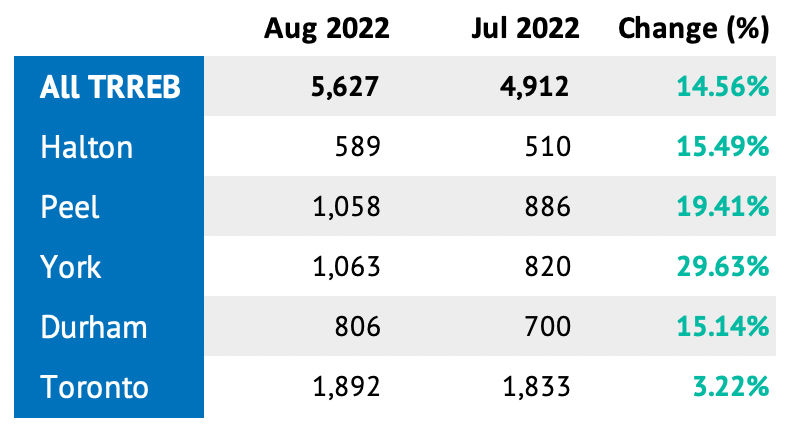

As I mentioned in my last report, in July 2022 we saw the lowest amount of TRREB sales in any July since 2001 at 4,912 which was almost 50% less than the previous year. In August we saw a bit of a reversal, with sales coming in at 5,627 which was 35% less than August 2021 , but a ~15% increase from July 2022.

Is this the start of a trend reversal? Impossible to say with only one month of data. If September’s stats come out significantly lower sales than last year, then this reversal could just be an anomaly. We probably won’t know until November-December when the fall market is in our rearview.

That being said, it’s promising that there was a month-over-month uptick in sales in August as it is historically slower than the month of July.

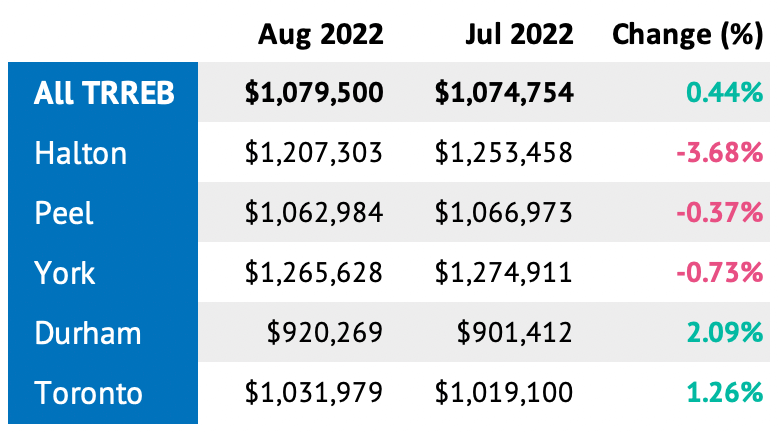

Average Sale Prices

With the exception of Halton, there was a stabilization of average sale price from July to August ( and even a slight increase in Toronto and Durham which I was quite surprised by).

I find this more promising than the sales numbers, however, this could be short-lived depending on how the recent oversized interest rate hike affects the market.

The gap between the last interest rate hike on July 13th and the most recent one on September 7th was 56 days which is the longest gap since the BoC started raising rates. It’s possible that this played a role in stabilizing prices in August with more buyers rushing to purchase before the most recent hike.

What I’ll Be Looking for in September

September is going to be a pivotal month for indicating which direction the market is heading. There are a few main areas I’ll be watching closely.

1) Inflation report on September 20th

July marked the first month since June 2021 that inflation declined, dropping from 8.1% to 7.6% from June to July 2022.

According to the Bank of Canada’s Sept 7th press release, this was mainly because of a drop in gasoline prices. They stated that if you exclude gasoline, inflation increased in July.

1 month is not a trend, and neither is 2, but when Stats Can reports August inflation on September 20th, it will effect market sentiment because most people only pay attention to the 7.6%, and not the BoC’s press release.

The BoC has another interest rate meeting on October 26th, meaning we will also get September’s inflation numbers before that meeting.

Scenario 1 – August Inflation is UP

If inflation is up in August, the market could start to price in the potential of another rate increase in October. I would assume this would continue the markets downward momentum if what happened after previous rate hikes is any indicator.

Scenario 2 – August Inflation is DOWN

If inflation is down in August, it increases the possibility the BoC holds interest rates until their Dec 7th meeting (though unlikely), or fingers crossed, revert to typical 25 basis point rate hike on October 26th.

That creates almost 3 months of potential stability in the interest rate, which could boost consumer confidence in the real estate market.

2) Sales to New Listings

The sales to new listing ratio (SNLR) is a measurement of the number of new listings to the number of sales in a given month.

SNLR = Number of Sales / New ListingsThis ratio is usually used to determine whether we are in a buyer or seller’s market, but is also a good indicator of supply and demand.

In a nutshell, are buyer’s purchasing properties as fast as seller’s are listing them?

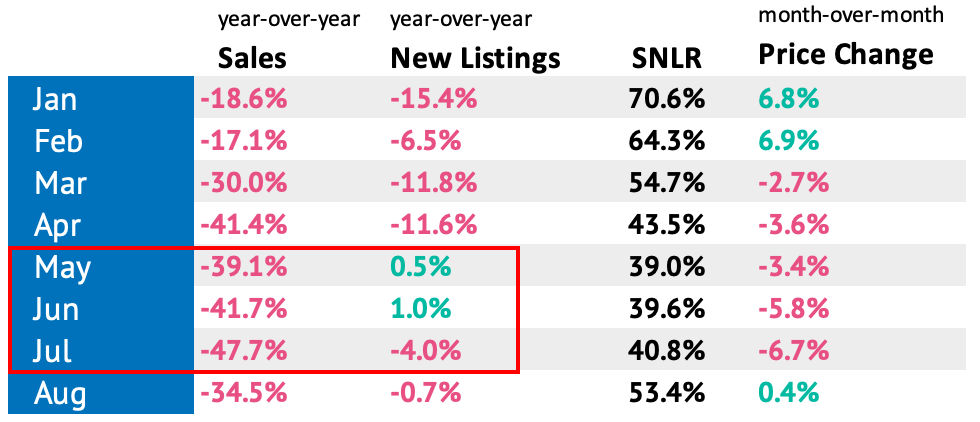

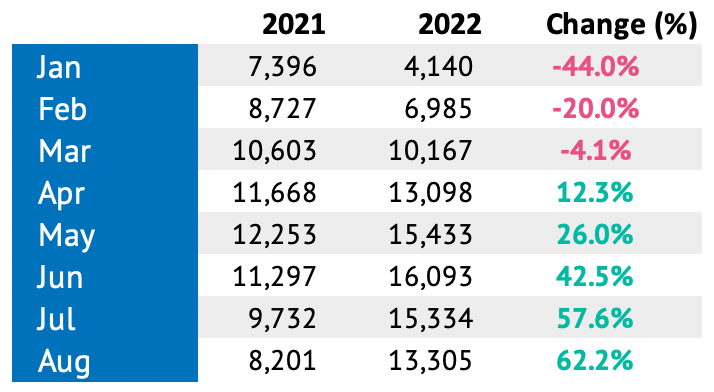

Take a look at January in the table above. In that month sales were down 18% compared to January 2021, but new listings were down by almost the same amount. They were staying in sync.

As soon as we hit February, the number of sales started to decline quickly, while new listings stayed relatively steady, causing inventory to build up. This is reflected in the SNLR in the 3rd column.

The higher the SNLR — less supply, more demand.

The lower the SNLR is — more supply, less demand (inventory is building up)

When the SNLR is 40% or below for a sustained period, this usually indicates a buyers market (though this number differs depending on who you talk to).

The area highlighted in red shows that this May, June and July inventory has started to build up as new listings are almost identical to last year, but sales are down by 40% or more, meaning less competition for buyers with the same amount of inventory.

The table shows how many active listings (inventory) have been building up over the last several months. As of August 2022 we had 62% more inventory than the same time last year, which is a significant increase in supply.

The reason I will be watching the SNLR closely in September is that the latest interest rate hike could push more inventory into the market than is typical for this time of year, while at the same time making it more difficult for buyers to qualify for a mortgage (pushing down demand).

If the SNLR dips below 50% in September, it is very likely that the positive signs we saw in August will reverse as well. I think this is the most likely scenario with. the amount of inventory that has already built up over the summer.

(If you have questions, need advice, or want to talk about the shift in the market, get in touch).